Payroll tax calculator sa

Sage Tax Calculator Try our easy-to-use income tax calculator aligned to the latest Budget Speech announcements. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Use ADPs South Carolina Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

. Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates. Younger than 65 years Between 65 and 75 years Older than 75 years. Subtract 12900 for Married otherwise.

For example if an employee earns 1500. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Unemployment insurance FUTA 6 of an employees first 7000 in wages 2022 2.

Digital Tools Sage has put together key business resources to assist. How to calculate annual income. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. The maximum an employee will pay in 2022 is 911400.

Update your billing details. Medicare 145 of an employees annual salary 1. Payroll Tax Threshold.

The state tax year is also 12 months but it differs from state to state. Young Over 65 Over 75. 2020 Federal income tax withholding calculation.

Just enter the wages tax withholdings and other information required. You must register for payroll tax once your Australia wide wages or group Australia wide wages exceed the maximum threshold. South Africa 20222023 Tax year.

Could be decreased due to state unemployment. Calculate Emergency Services Levy Calculate Emergency Services Levy Menu. Enter taxable income to calculate your tax.

Show submenu for Payroll Tax Payroll Tax Menu. Weekly Fortnightly Monthly Yearly. FAQ Blog Calculators Students Logbook.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Some states follow the federal tax.

How To Calculate Payroll Taxes In 5 Steps

Payroll Tax Wikiwand

Payroll Calculator Free Employee Payroll Template For Excel

Income Arising From Indian Assets Is Taxable For Nris Welcomenri Payroll Software Tax Saving Investment How To Introduce Yourself

What Are Payroll Deductions Article

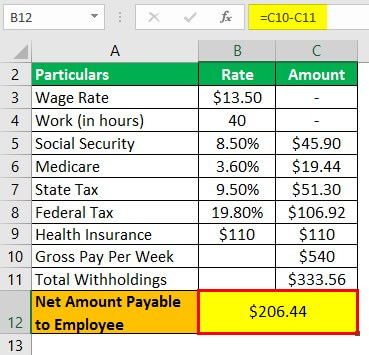

Payroll Formula Step By Step Calculation With Examples

How To Calculate Payroll Taxes In 5 Steps

Payslip Salary Slip South Africa Templates Downloadable Resume Template Payroll Template

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How To Pay Your Nanny S Taxes Yourself Nanny Tax Nanny Payroll Payroll Template

Biweekly Time Sheet Invoice Template Word Timesheet Template Card Templates Free

Macrs Depreciation Calculator Table Calculator Table Guide Fixed Asset

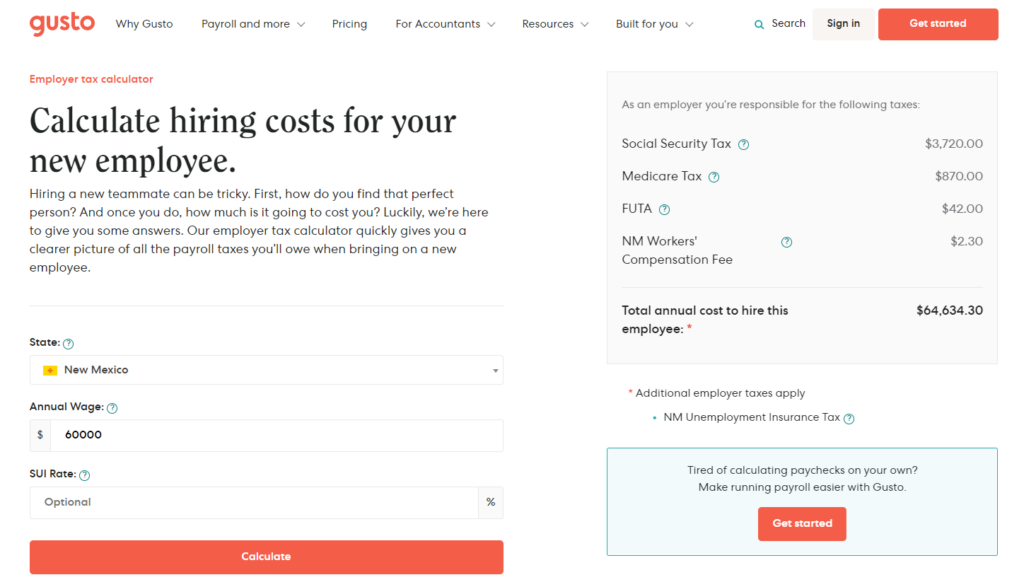

What Are Employer Taxes And Employee Taxes Gusto

Solved Payroll Taxes Not Deducted Correctly

Solved Employer Payroll Tax Expense Account

Free Payroll Tax Paycheck Calculator Youtube

How To Do Payroll In Excel In 7 Steps Free Template